Property Investment in Limassol: Yields, Price Growth & Risks for 2025

13 August 2025

Limassol has firmly established itself as the powerhouse of Cyprus’s property market, attracting both local and international investors with its strong rental yields, consistent capital appreciation, and resilient demand.

In 2025, the city continues to deliver some of the most attractive real estate returns in the Mediterranean, making it a prime target for those seeking both steady income and long-term value growth.

At Square One, we understand these dynamics better than anyone.

As a company developed by investors, for investors, our mission is to maximise returns through high-yield properties, strategic locations, and a proven portfolio that consistently performs.

Why Limassol is a Standout Investment Destination

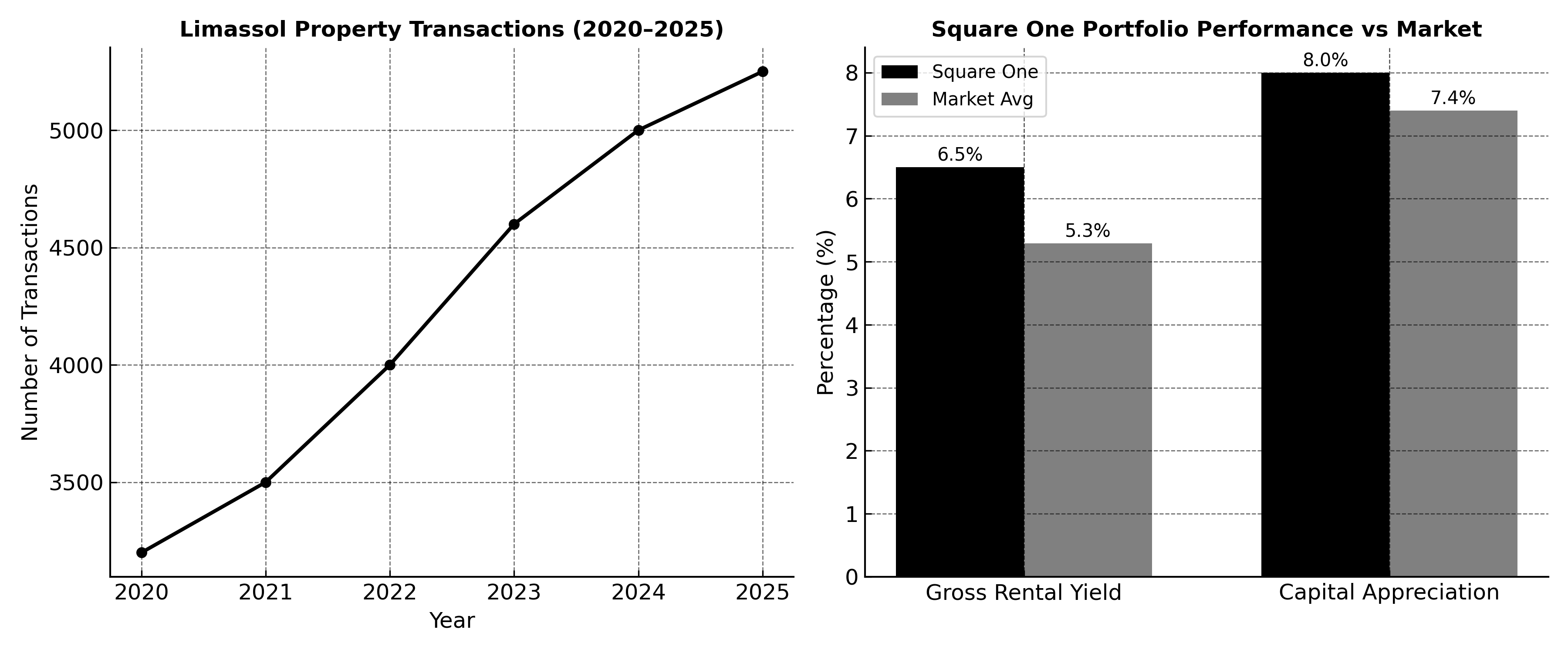

Limassol continues to lead Cyprus in both transaction volume and property prices, accounting for over 40% of all real estate sales nationwide (Investropa).

This dominance is fuelled by the city’s role as an international business hub, a magnet for high-net-worth individuals, and a lifestyle destination offering luxury amenities, high-quality infrastructure, and year-round appeal.

Ongoing development projects, such as the City of Dreams Mediterranean resort in Zakaki, have further elevated Limassol’s global profile.

As highlighted in our recent feature, The COLLECTION – Square One’s Latest Residential Investment in Limassol City Centre, prime developments in central, high-demand areas remain the most attractive for both rental performance and appreciation potential.

Rental Yields: Generating Reliable Income

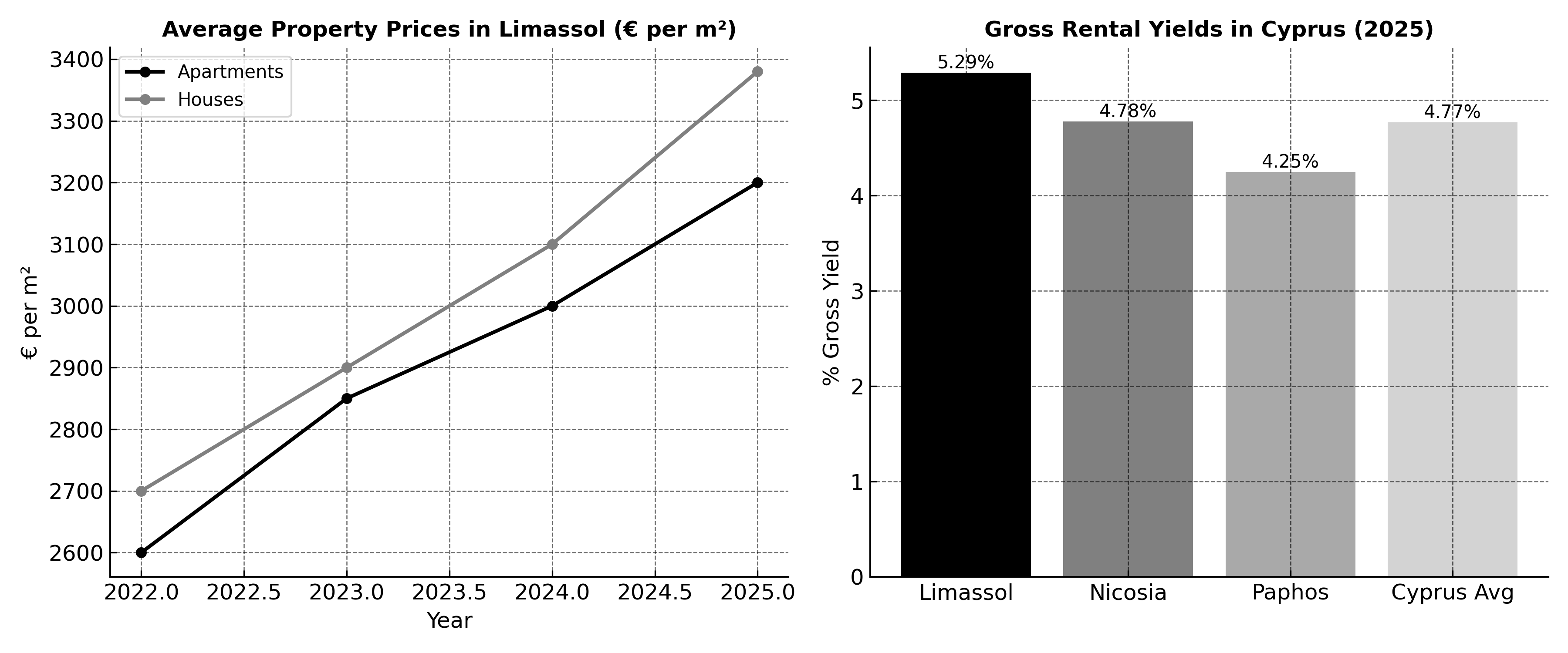

In 2025, gross rental yields in Limassol average around 5.29%, outperforming the Cyprus-wide average of 4.77% (Global Property Guide).

Depending on property type, location, and management strategy, yields in Limassol typically range between 5% and 7%, with premium short-term rental properties in prime districts achieving results at the top of that range.

In our detailed guide, Maximizing Rental Yields in Cyprus in 2025, we explored how strategic furnishing, location selection, and professional property management can significantly increase investor returns.

At Square One, we apply this knowledge to our own portfolio, targeting properties that consistently deliver high occupancy rates and strong income performance.

Price Growth: Building Long-Term Value

Limassol offers not only strong rental yields but also compelling capital appreciation. Average apartment prices have grown by 7.4% year-on-year, now averaging around €3,200 per m² (Investropa).

Detached houses have performed even better, recording a 9.1% increase in Q1 2025, while apartments rose 2.6% over the same period (Cyprus Domus).

Across Cyprus, apartments increased ~8.8% and houses ~6% in the past year, while May 2025 marked the busiest month for property sales since 2007 with a 30% year-on-year increase (Berkos).

These trends align with our findings in Cyprus Property Market in 2025: What It Means for Property Investors, which highlighted how Limassol remains a key driver of nationwide price growth.

Risk Factors to Consider

Even in a thriving market like Limassol, investors should remain aware of potential risks. High entry prices in prime areas can narrow yield margins, particularly in apartment segments showing slower growth compared to houses.

Rising mortgage rates, currently in the 3–4% range, could moderate buyer demand.

The market’s heavy reliance on foreign investors—who make up nearly 50% of all transactions—means that changes in residency laws, taxation, or geopolitical conditions could influence demand.

Additionally, limited land availability in central areas keeps prices high but can also restrict supply flexibility.

At Square One, we actively monitor these market variables and adapt our strategies accordingly, ensuring our investors remain positioned for resilience and growth.

Square One: Developed by Investors, for Investors

Our business model is built entirely around the needs of investors.

Every Square One development is designed to deliver both strong rental performance and solid capital appreciation.

Our projects consistently achieve gross rental yields of 5–7% by focusing on prime, high-demand locations and optimising design and layouts for tenant appeal.

As an investor-focused developer, we don’t just hand over the keys — we offer turnkey solutions that cover everything from acquisition to property management, ensuring a completely hands-off investment experience.

Our proven track record across Limassol demonstrates that our approach works, and our growing portfolio continues to outperform market averages.

Conclusion

Limassol’s property market in 2025 offers a rare combination of high yields, steady price appreciation, and strong buyer demand, all within a city that continues to strengthen its position as an international hub.

For investors, success lies in choosing the right assets — properties that deliver immediate income while appreciating in value over time.

At Square One, our deep understanding of market trends, combined with our investor-first approach, ensures our clients get access to the best opportunities in the city.

Whether you’re looking for rental income, capital growth, or both, our proven portfolio is designed to help you achieve your financial goals.

Ready to explore Limassol’s top investment opportunities?

View our current projects and see how we can help you secure your next high-performing property.