Cyprus Property Market in 2025: What it means for property investors

13 June 2025

What May 2025 Property Sales Reveal About Cyprus' Real Estate Boom

At Square One, we closely monitor market dynamics to guide our investors. May 2025 brought another standout month for Cyprus real estate.

As reported by Cyprus Property Buyers, 1,664 contracts of sale were deposited across the island — a 30% increase from May 2024’s 1,268.

This impressive performance is a continuation of the trend we reported in our recent article, Cyprus Sales Surge: 2025 Property Market Breaks Records, confirming Cyprus’ resilience as an investment destination.

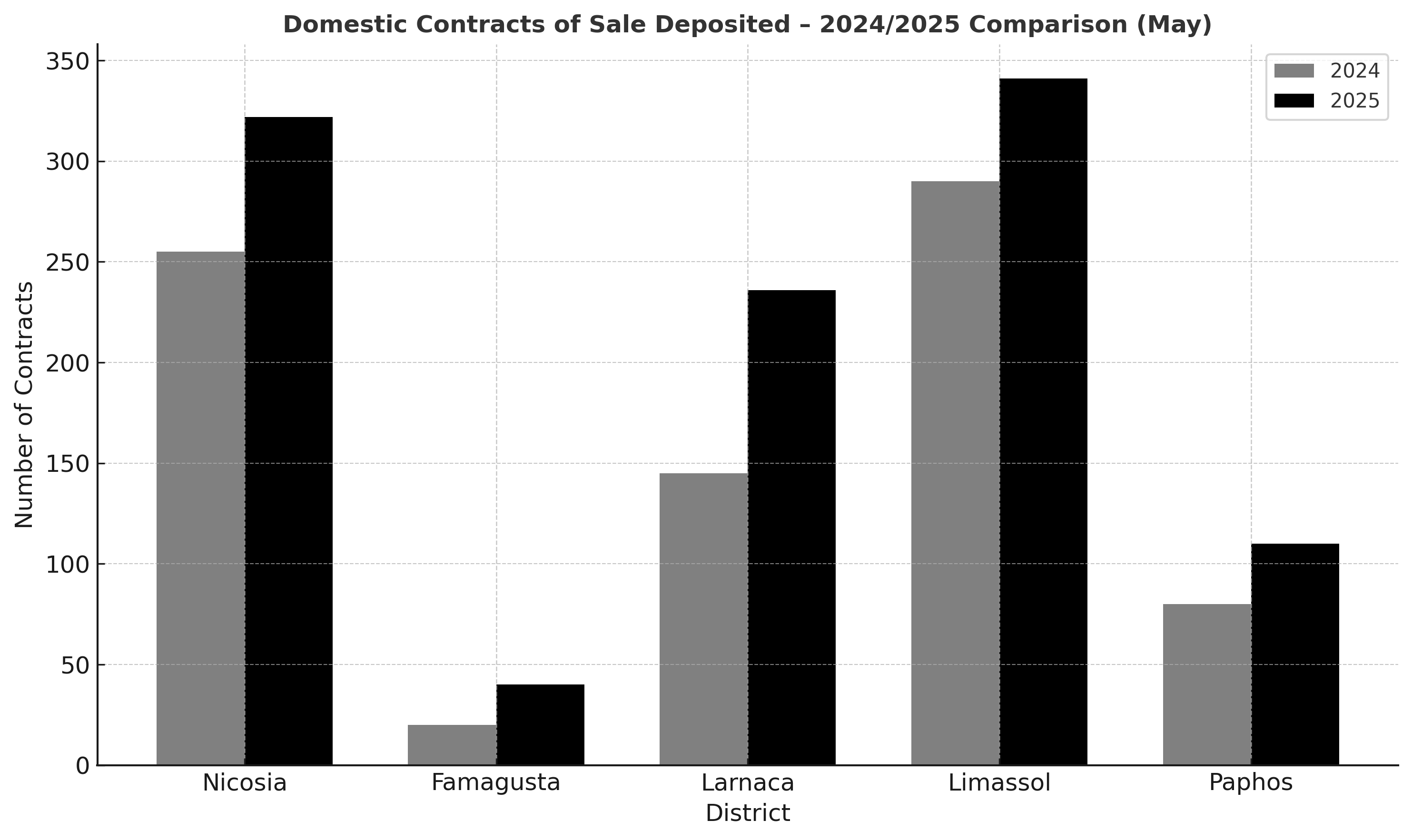

1. Domestic Market: Local Confidence Reaches New Heights

The domestic segment showed exceptional growth. In May 2025, Cypriot nationals filed 1,055 contracts — up 35% from May 2024.

This growth was seen across every district:

- Limassol: 341 (+17%)

- Nicosia: 322 (+31%)

- Larnaca: 236 (+66%)

- Paphos: 110 (+38%)

- Famagusta: 40 (+109%)

Year-to-date domestic sales reached 4,373, a 16% increase compared to the same period last year. Larnaca and Nicosia, in particular, are emerging as hotspots for first-time buyers and locals seeking affordability with proximity to urban centres.

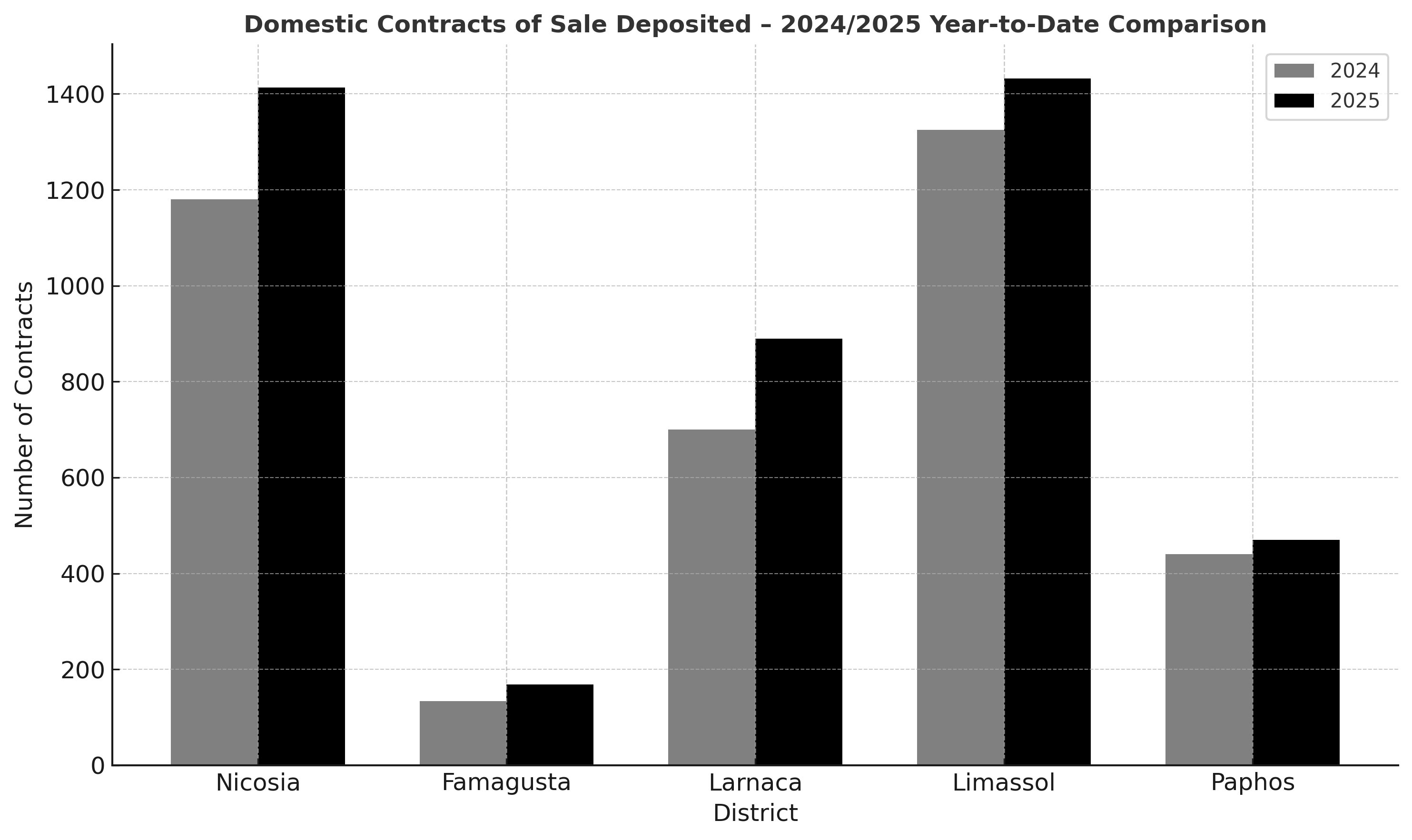

2. Domestic sales year-to-date (Jan–May 2025)

Overall, 4,373 sales have been registered in the domestic market so far in 2025 – a 16% increase from the 3,781 recorded during the same period last year, with all districts reporting gains.

- Limassol: 1,432 (+8%)

- Nicosia: 1,413 (+20%)

- Larnaca: 890 (+27%)

- Paphos: 470 (+7%)

- Famagusta: 168 (+25%)

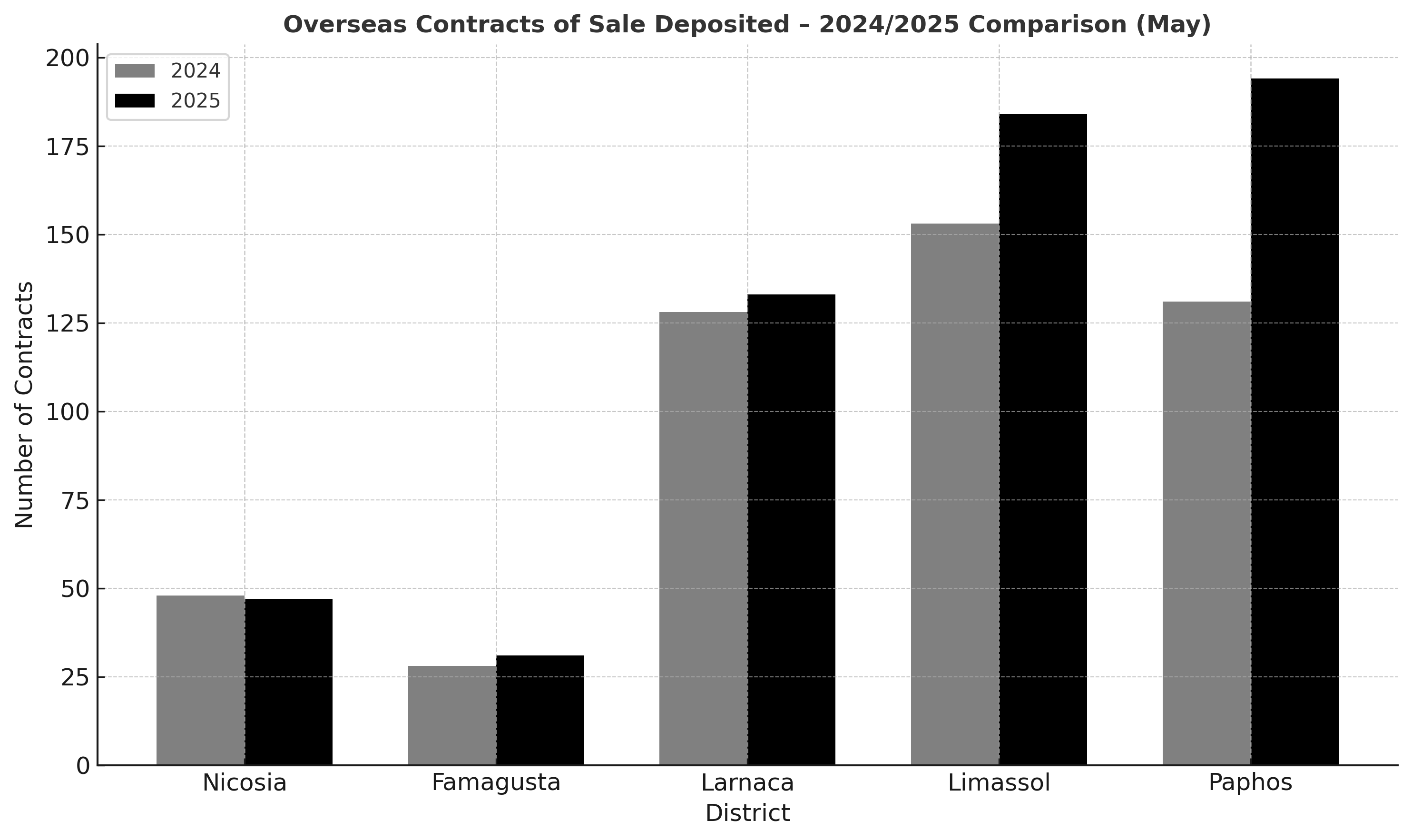

3. Foreign Buyers: Strong Demand from EU and Non-EU Markets

Cyprus remains a top choice for overseas investors. May 2025 saw 589 property transactions by foreign buyers — a 21% increase from May 2024.

Paphos and Limassol are driving this demand:

- Paphos: 194 (+48%)

- Limassol: 184 (+20%)

- Larnaca: 133 (+4%)

- Nicosia: 47 (-2%)

- Famagusta: 31 (+11%)

Year-to-date, international sales totalled 2,812 (+15%).

4. Overseas sales year-to-date (Jan–May 2025)

A total of 2,812 sales by foreign buyers have been recorded so far in 2025 – a 15% increase from 2,450 over the same period last year, with all districts reporting gains.

- Limassol: 849 (+24%)

- Nicosia: 242 (+3%)

- Paphos: 901 (+13%)

- Larnaca: 664 (+11%)

- Famagusta: 156 (+14%)

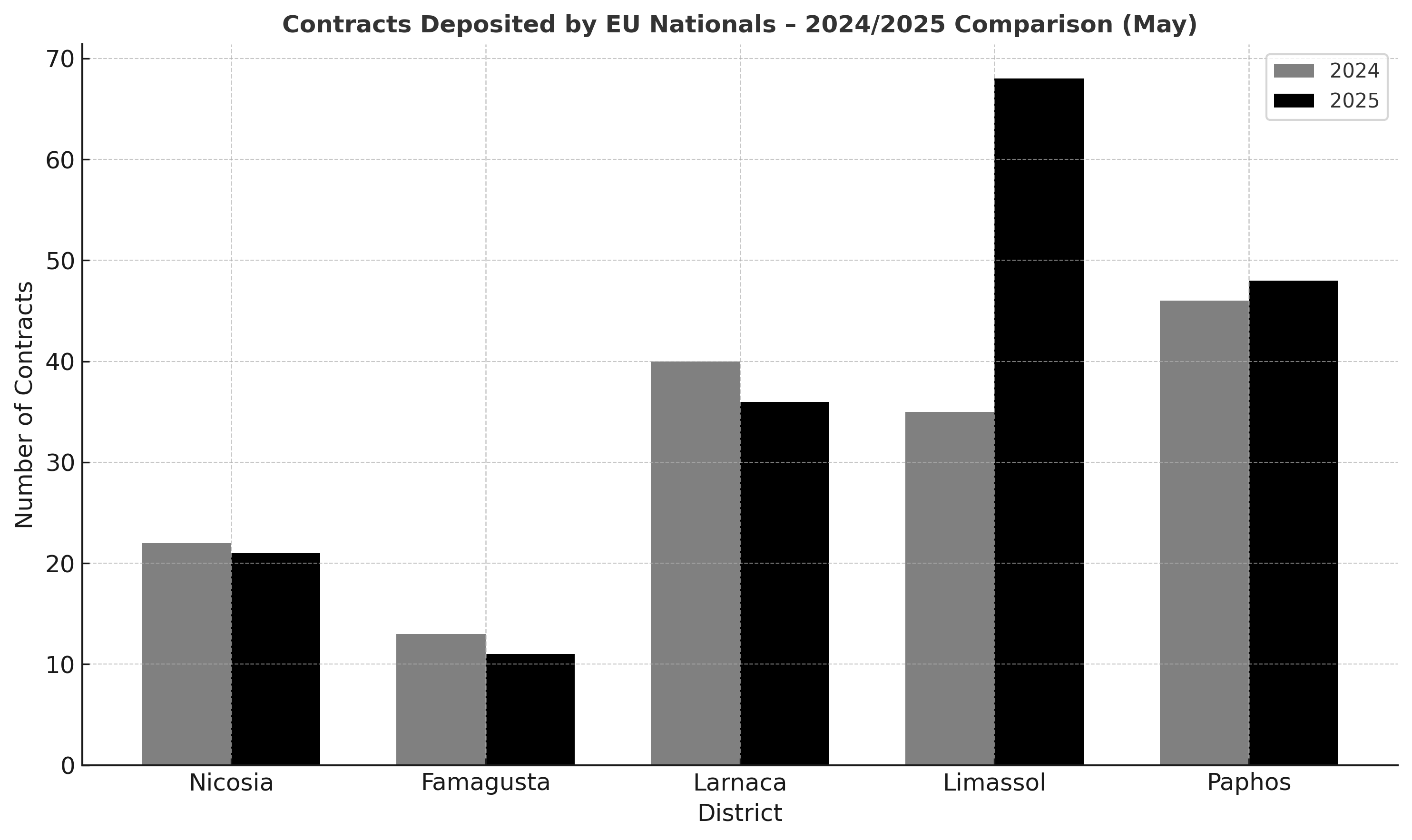

5. Spotlight on EU vs Non-EU Buyer Trends

EU Nationals recorded 184 property sales in May, a 17% increase YoY. Limassol and Paphos led this growth, while Larnaca and Nicosia saw slight drops.

May 2025 EU buyer sales by district:

- Limassol: 68 (+94%)

- Paphos: 48 (+4%)

- Larnaca: 36 (-10%)

- Nicosia: 21 (-5%)

- Famagusta: 11 (-21%)

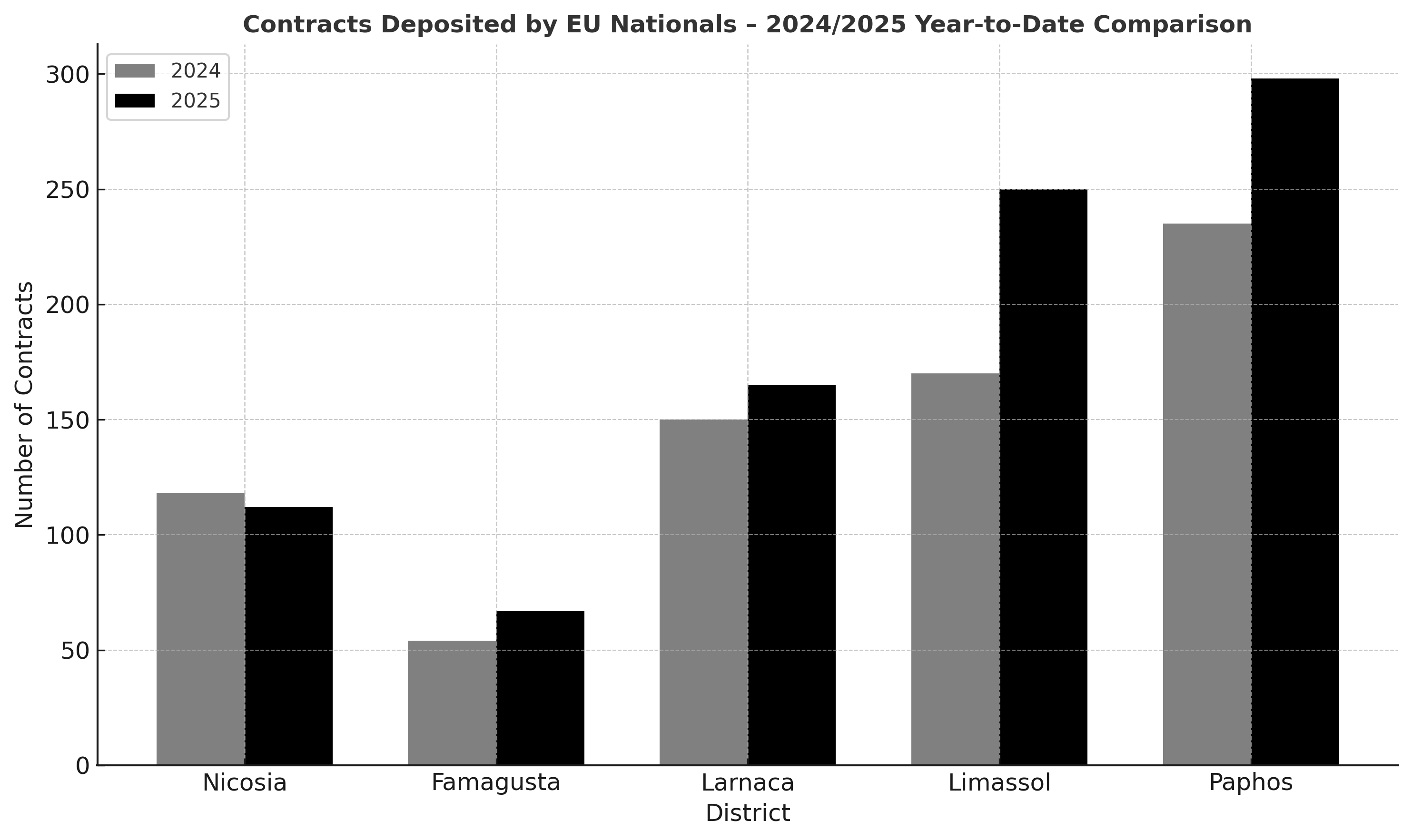

EU Buyer sales year-to-date (Jan–May 2025)

Sales to EU nationals reached 724 so far this year – up 29% from 561 in the same period of 2024, with all districts reporting gains except for Nicosia.

- Limassol: 183 (+38%)

- Nicosia: 92 (-6%)

- Paphos: 251 (+41%)

- Larnaca: 131 (+18%)

- Famagusta: 67 (+56%)

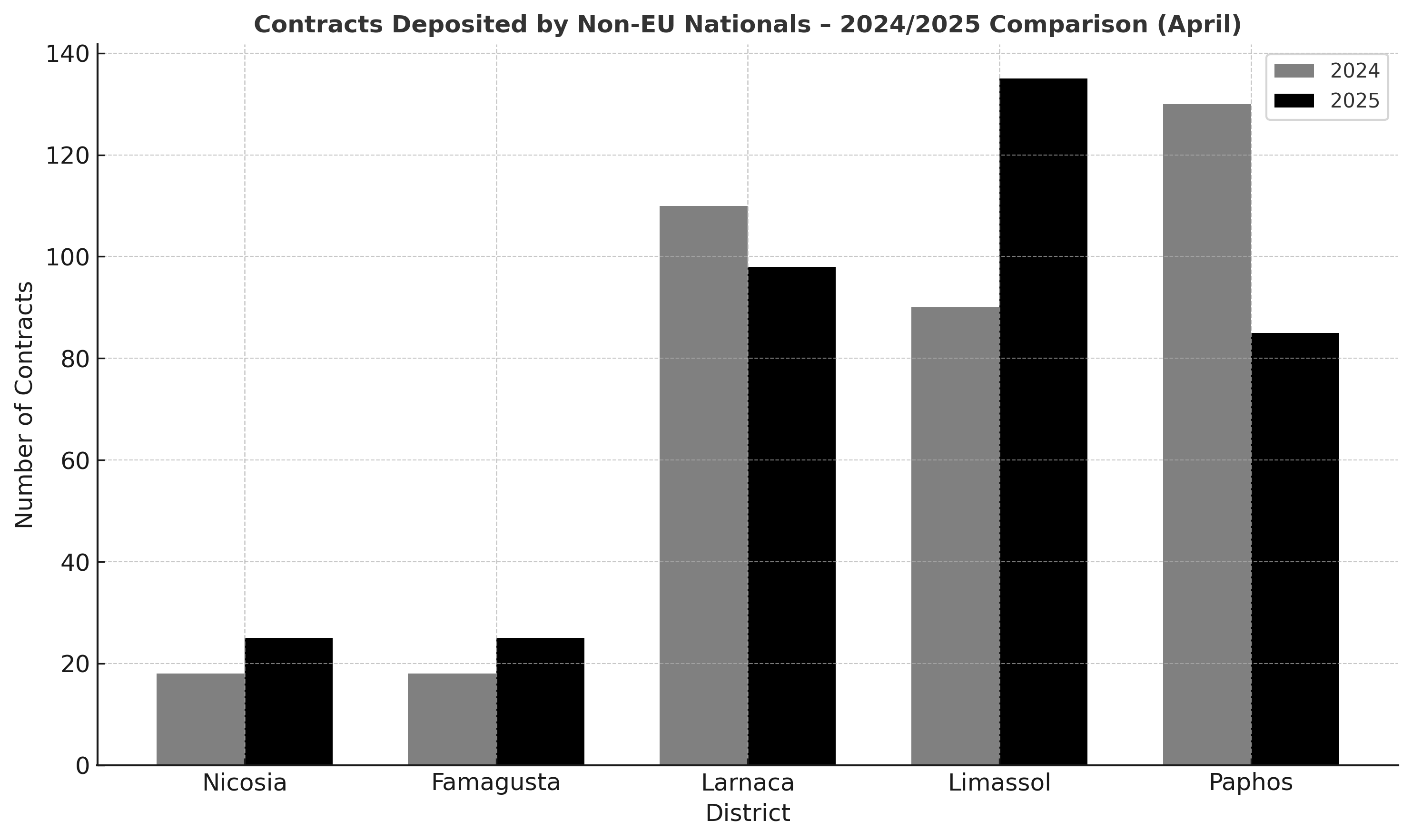

Non-EU Nationals continued to play a major role in the overseas property market. In May 2025, sales to non-EU citizens rose by 22%, reaching 405 transactions compared to 331 in May 2024. All districts recorded increases except Limassol, which saw a minor dip.

May 2025 Non-EU Buyer Sales by District:

- Limassol: 166 (−2%)

- Nicosia: 226 (no change)

- Paphos: 146 (+72%)

- Larnaca: 97 (+10%)

- Famagusta: 20 (+43%)

Year-to-date sales reached 1,904, reflecting a 10% increase compared to the same period in 2024.

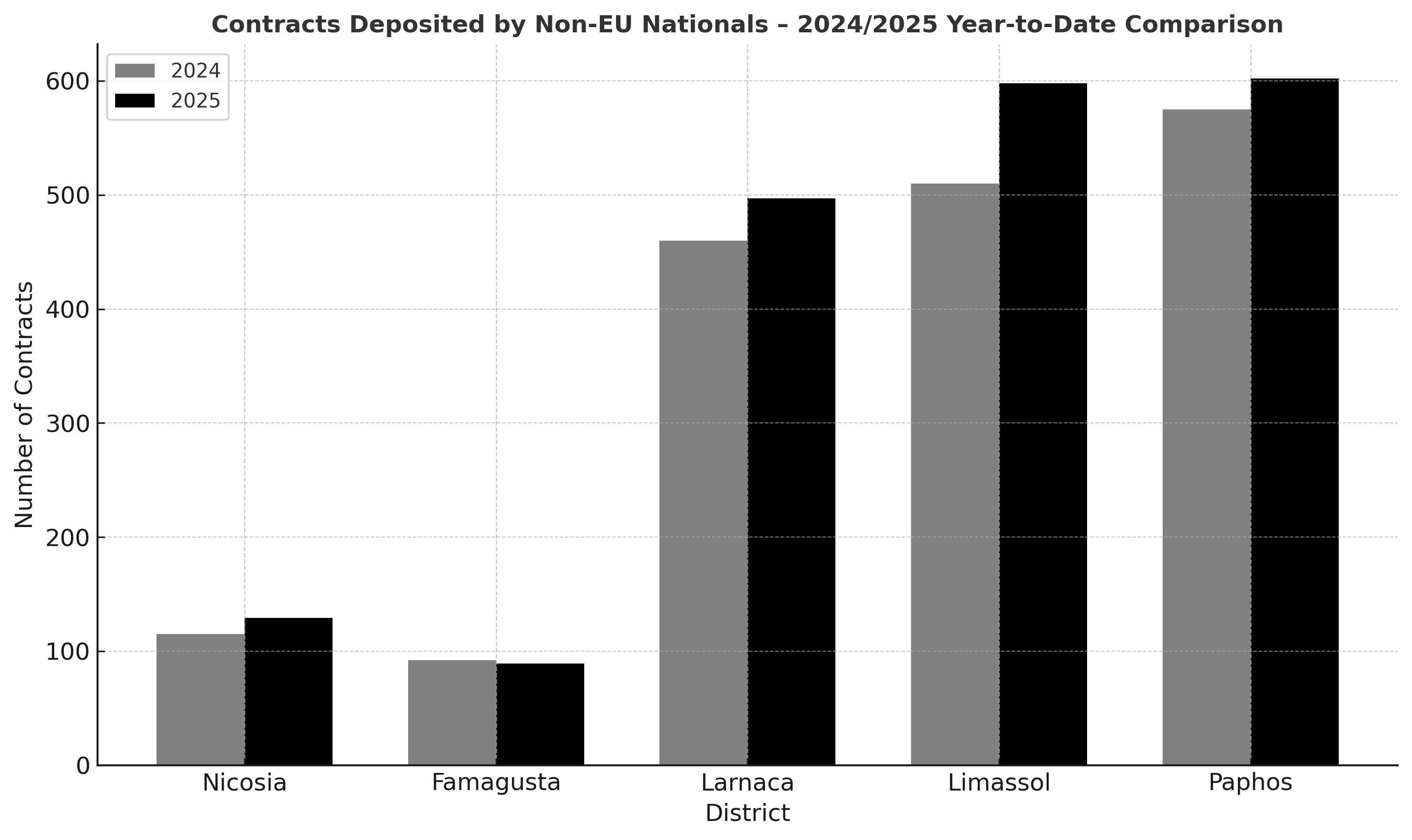

Non-EU Buyer Sales Year-to-Date (Jan–May 2025)

During the first five months of 2025, property sales to non-EU citizens totalled 1,904, marking a 10% increase compared to 1,730 sales during the same period in 2024. Most districts saw steady growth, with the exception of Famagusta, which recorded a slight decline.

Year-to-Date Non-EU Sales by District:

- Limassol: 598 (+16%)

- Nicosia: 129 (+12%)

- Paphos: 602 (+5%)

- Larnaca: 497 (+11%)

- Famagusta: 78 (−3%)

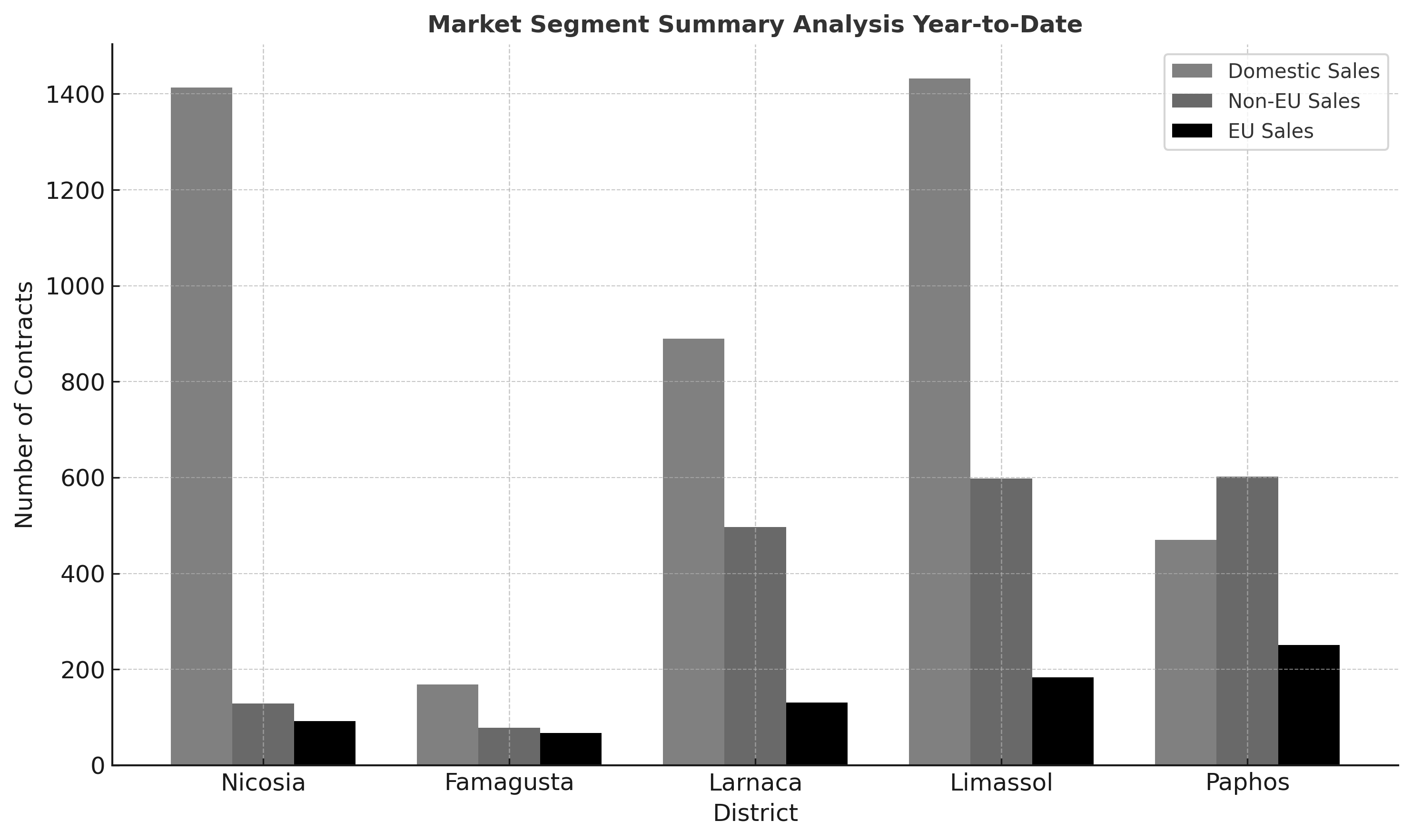

6. Comparative Market Segment Overview

The diversity of Cyprus’ buyer profiles is a major strength. Here’s how the market splits across domestic, EU, and non-EU buyers:

This segmentation highlights a healthy mix of investor profiles, reducing market volatility and increasing long-term confidence.

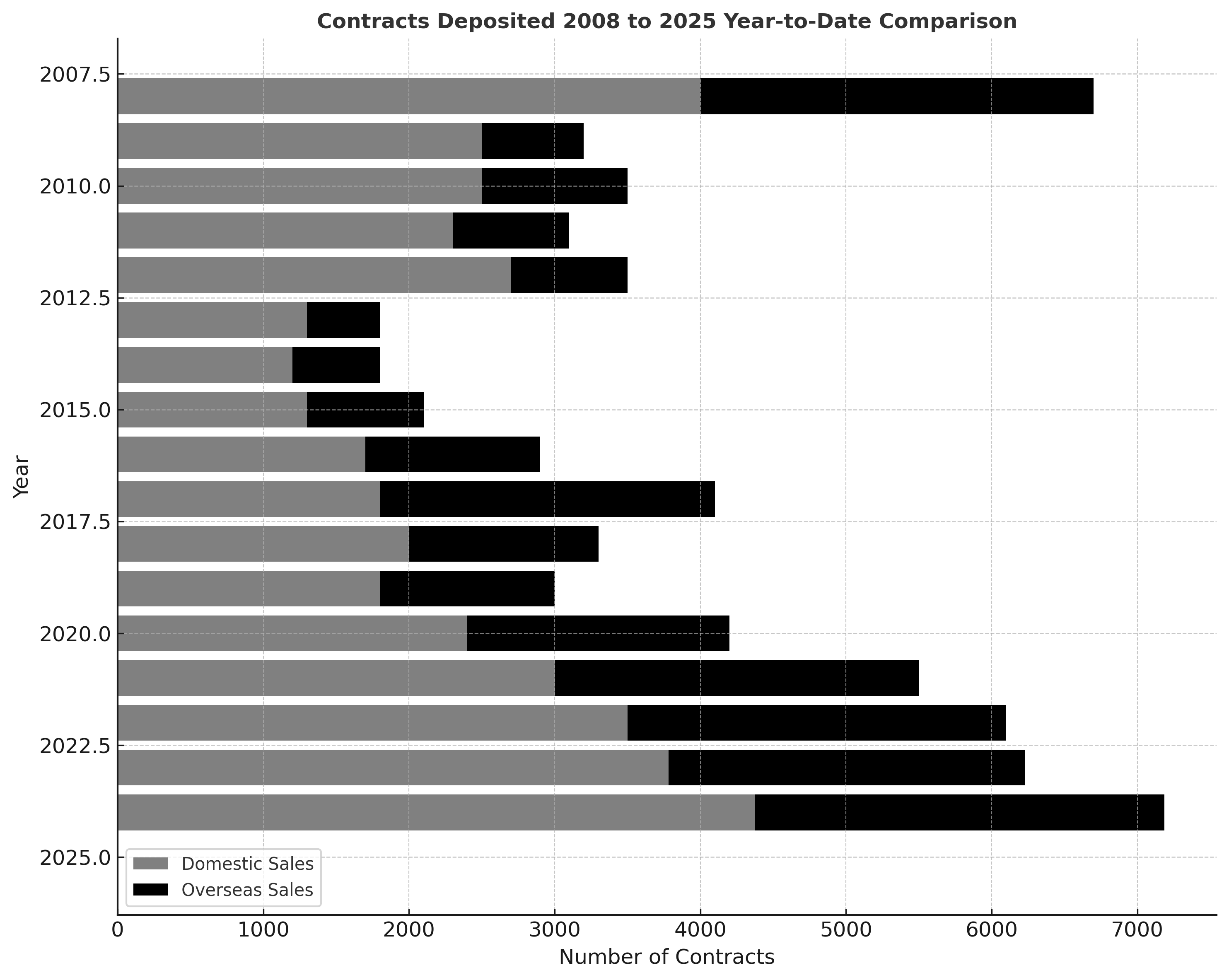

7. Historical Perspective: Cyprus Sales Since 2008

A look at contracts from 2008 to 2025 shows how significantly the market has matured and stabilised over time:

Despite global economic shifts and local challenges, Cyprus has consistently shown resilience, particularly in the post-2020 recovery period.

8. Investment Outlook on the Cyprus Property Market

With strong data from both local and international markets, Cyprus continues to offer high-yield potential.

At Square One, we’re aligning our projects to meet the needs of today’s buyers:

- Affordable yet high-spec units in central locations

- 2-bedroom apartments optimised at 65 sqm for ROI

- Full-service property management through Moving Doors

- Rental guarantees of up to 7%

Whether you’re a first-time investor or expanding your portfolio, the latest figures offer a compelling reason to act now.

With limited inventory, rising demand, and strong rental yields, Cyprus is no longer a "hidden gem" — it's a market in full bloom.

Contact us today at invest@squareone.com.cy or explore our latest projects to secure your next investment in Cyprus real estate.

Disclaimer

This article is provided for general information purposes only and does not constitute legal or tax advice. Always consult a licensed tax advisor for personalised guidance.