Cyprus Tax Residency & Non-Dom Benefits Explained: The Ultimate Guide for Investors

30 April 2025

At Square One, we work closely with foreign investors looking to maximise returns through Cyprus’s thriving real estate market. One of the biggest advantages?

Cyprus’s exceptionally favourable tax system—especially for those who gain Cyprus tax residency or qualify for the non-domicile (non-dom) regime.

This guide will explain the 60-day rule vs 183-day rule, non-dom Cyprus benefits, and how investors can legally reduce their global tax liabilities while owning high-performing properties.

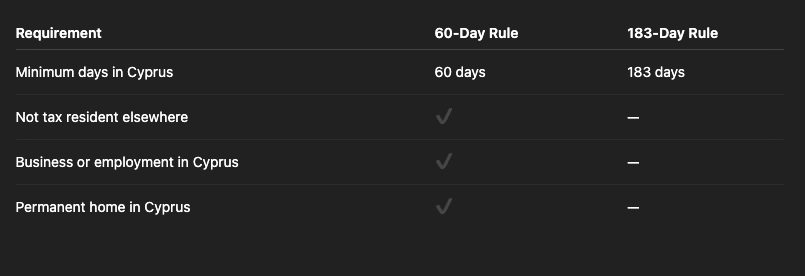

Cyprus Tax Residency: Understanding the 60-Day vs 183-Day Rule

Cyprus offers two ways to become a tax resident, depending on your lifestyle and business commitments.

The 183-Day Rule

You're considered a Cyprus tax resident if you spend more than 183 days in Cyprus in a calendar year (Jan–Dec).

The 60-Day Rule Cyprus

Ideal for digital nomads and international investors. To qualify under the 60-day rule, you must:

- Spend at least 60 days in Cyprus per year

- Not be tax resident elsewhere

- Not spend more than 183 days in any other single country

- Carry out business or employment in Cyprus (or be a director of a Cyprus tax-resident company)

- Maintain a residential property in Cyprus (owned or rented)

This rule offers incredible flexibility and full access to Cyprus’s tax benefits.

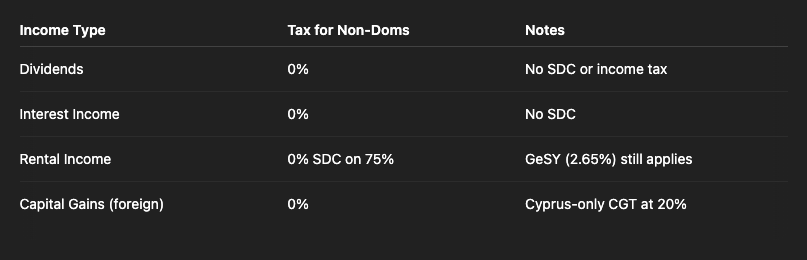

The Power of Non-Dom Cyprus Status

Cyprus’s non-domicile regime makes it one of Europe’s most tax-friendly countries for passive income.

Who Qualifies?

You are non-domiciled in Cyprus if:

- You were not born in Cyprus to Cypriot parents, and

- You have not been a Cyprus tax resident for at least 17 of the past 20 years

Key Non-Dom Cyprus Benefits

Income Type Tax Treatment for Non-Doms Dividends 0% SDC (17% exemption) Interest Income 0% SDC (30% exemption) Rental Income 0% SDC on 75% of income

Note: You may still pay income tax and GeSY (2.65%) where applicable.

This makes Cyprus a highly strategic base for wealthy individuals, company shareholders, and international landlords.

What Income Is Taxed vs Exempt in Cyprus?

Cyprus tax residents are taxed on worldwide income, but with major reliefs and exemptions.

Income Tax Rates (2024)

- Up to €19,500 – 0%

- €19,501–28,000 – 20%

- €28,001–36,300 – 25%

- €36,301–60,000 – 30%

- €60,000+ – 35%

What’s Tax-Exempt?

- Dividends & Interest: Non-doms pay 0% tax

- Foreign pensions: Option to pay a flat 5% on income above €3,420

- Capital gains (non-Cyprus real estate): Exempt

- Rental income: 80% is taxable, with deductions; SDC exempt for non-doms

Special Defence Contribution (SDC): What Non-Doms Avoid

SDC is typically charged on passive income:

Income Source Standard SDC Rate SDC for Non-Doms Dividends 17% 0% Interest 30% 0% Rental Income 3% on 75% of rent 0%

Thanks to SDC exemptions, non-doms in Cyprus often pay no tax at all on passive international income.

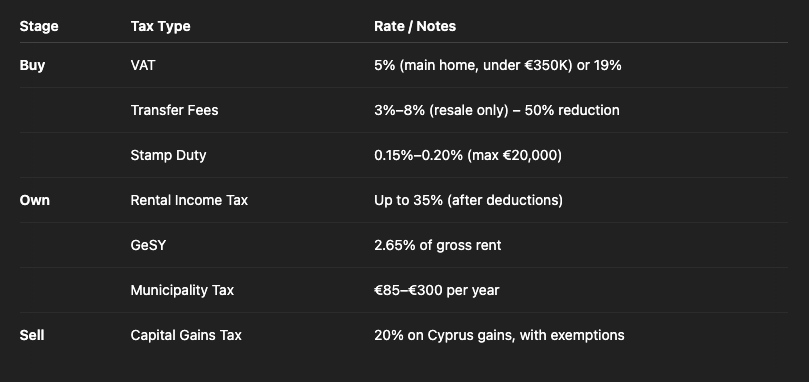

Real Estate Taxes in Cyprus (Quick Overview for Investors)

If you’re buying or owning property in Cyprus, here are the key taxes to know:

Case Example: Non-Dom Investor in Action

Investor A, a non-EU entrepreneur, relocates to Cyprus under the 60-day rule. He earns €75,000 in foreign dividends and €24,000 from short-term rentals in Cyprus.

Here’s his tax bill:

- Dividends: €0 (Non-dom SDC exemption)

- Rental Income:

Total tax exposure: Very low, and he qualifies for the 5% VAT on his primary residence.

Corporate Tax Benefits (for Business-Minded Investors)

Cyprus companies benefit from:

- 12.5% corporate tax (proposed to rise to 15%)

- 0% tax on disposal of shares/securities

- No withholding tax on dividends, interest, or royalties paid to non-residents

- Notional Interest Deduction (NID) – reduces tax to ~2.5%

- IP Regime – 80% exemption on qualifying IP profits

Perfect for holding companies, property portfolios, and IP-heavy businesses.

Why Choose Square One?

At Square One, we simplify the investment journey in Cyprus with:

- 32 high-yield residential projects in Limassol & Paphos

- Turnkey property solutions with legal, tax, and rental support

- Partnerships with Moving Doors, offering 7% rental guarantees and full property management

- Custom support for investors seeking residency, tax planning, and income-generating assets

We don’t just build properties—we build smart investment portfolios in one of Europe’s most tax-efficient real estate markets.

Related Articles:

- Buy-to-Let Guide Limassol: Benefits of Investing with SQONE

- Cyprus Real Estate Market Overview 2024

- Overview of the Cyprus Rental Market in 2024

Ready to Invest Smart and Live Tax-Efficient?

Contact Square One today and explore how you can take advantage of Cyprus tax residency, the non-dom regime, and secure high-yield investment property.

View our portfolio or request a consultation at www.squareone.com.cy

Disclaimer

This article is provided for general information purposes only and does not constitute legal or tax advice. Always consult a licensed tax advisor for personalised guidance.