Cyprus Property Sales on Track for Best Year Since 2007: A Comprehensive Market Analysis for Investors

8 December 2025

Cyprus is entering one of the strongest real estate cycles in nearly two decades. With contract deposits rising across all major districts, the island is on track to record its best property sales year since 2007 and the third-highest year on record since 2000.

This upward trajectory reflects the island’s expanding economy, strong interest from domestic and international buyers, increased demand for rental property, and a consistent shortage of high-quality residential units.

As one of the fastest-growing real estate developers in Cyprus, Square One offers a unique perspective on how market forces are reshaping investment opportunities, particularly in Limassol, the country’s most dynamic and high-performing district.

Official Sales Data: November 2025 Confirms Strong Momentum

According to the latest statistics published by the Department of Lands & Surveys, property sale contracts increased by 9 per cent year-on-year in November 2025, reaching 1,644 deposits, compared with 1,506 in November 2024.

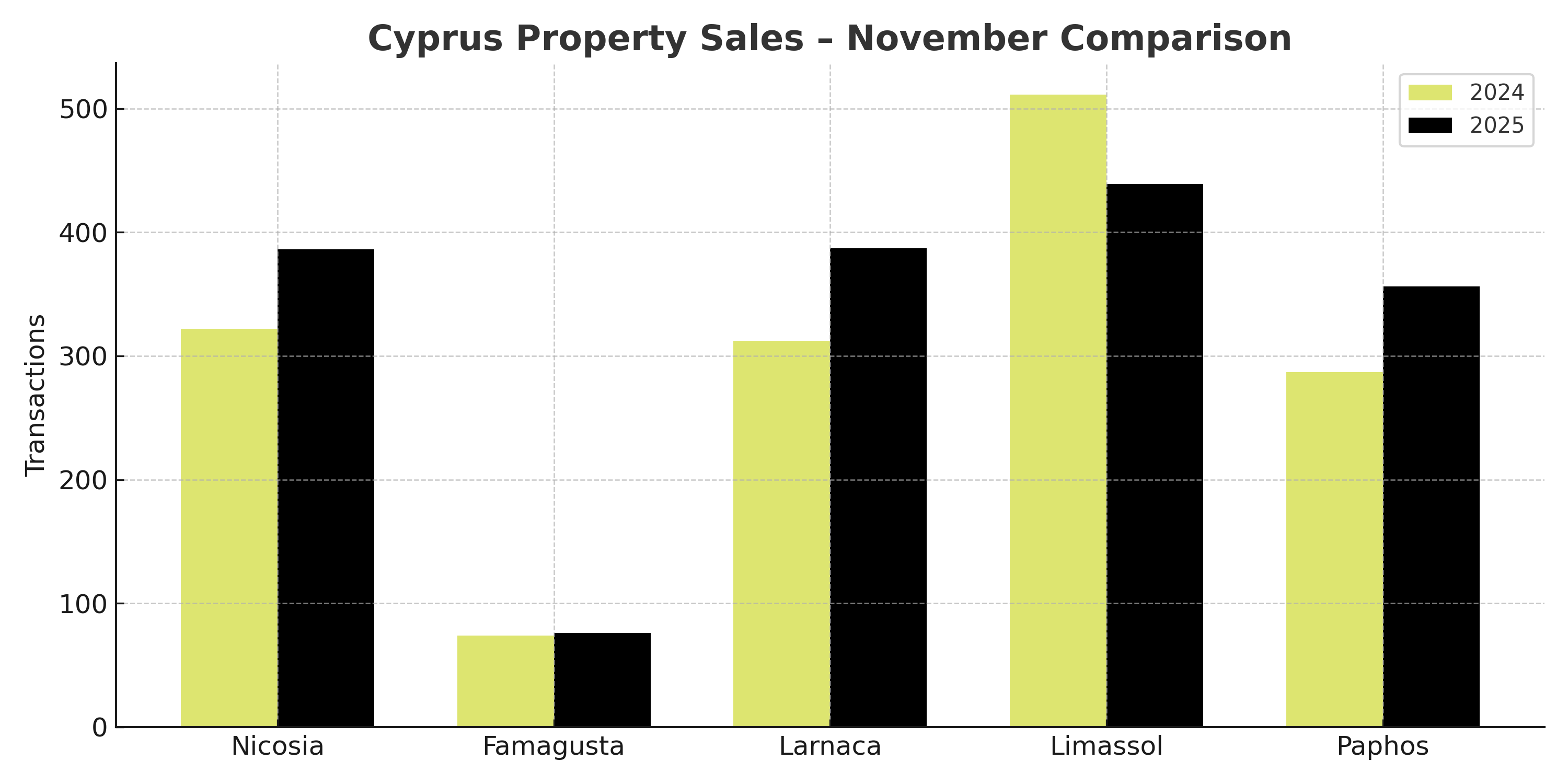

District-by-District Comparison: November 2025 vs November 2024

Four out of five districts recorded year-on-year growth:

- Nicosia: 386 vs 322 (+20%)

- Limassol: 439 vs 511 (–14%)

- Larnaca: 387 vs 312 (+24%)

- Famagusta: 76 vs 74 (+3%)

- Paphos: 356 vs 287 (+24%)

Despite a mild reduction in sales, Limassol continues to lead the market, registering the highest number of monthly transactions. This reflects its ongoing appeal as the commercial, financial, and lifestyle hub of Cyprus.

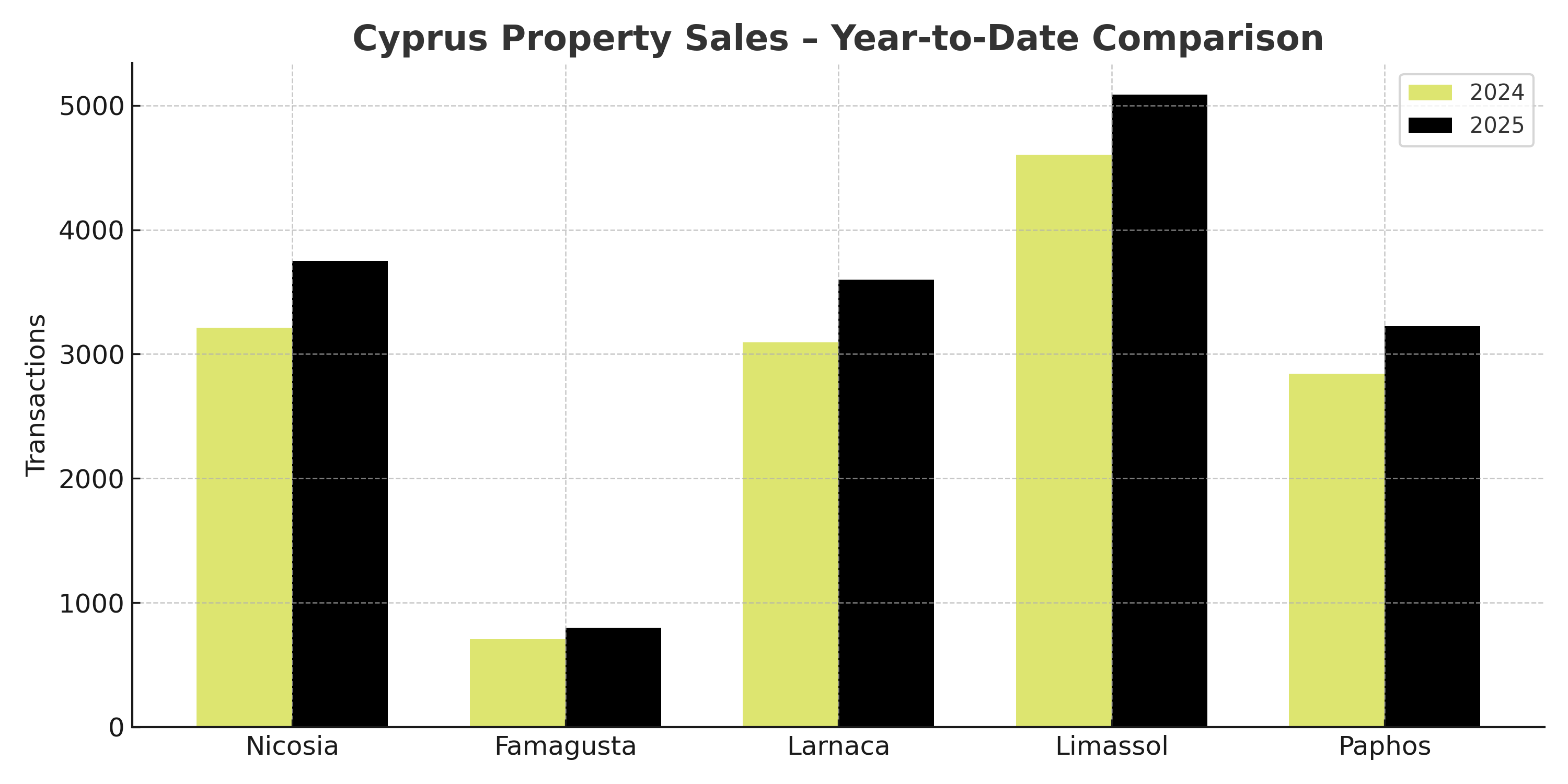

Year-to-Date Performance: All Districts Achieve Double-Digit Growth

The first eleven months of 2025 recorded 16,455 total property sales, compared with 14,458 in the same period of 2024, an impressive 14 per cent increase.

2025 Year-to-Date Sales by District

- Nicosia: 3,749 vs 3,212 (+17%)

- Limassol: 5,085 vs 4,604 (+10%)

- Larnaca: 3,598 vs 3,093 (+16%)

- Famagusta: 798 vs 708 (+13%)

- Paphos: 3,225 vs 2,841 (+14%)

This across-the-board growth underscores the stability of the Cyprus real estate sector, as all regions benefit from increased buyer interest and improving economic conditions.

Why Cyprus Is Experiencing One of Its Strongest Real Estate Cycles

Below are the key market forces shaping today’s performance and supporting long-term growth.

1. Rising Demand from Foreign Investors and Relocation Clients

Cyprus continues to attract professionals, entrepreneurs, digital nomads, and EU/non-EU relocation clients due to:

- Low taxation and business-friendly policies

- Strong international connectivity

- High living standards

- English-speaking services

- A stable and secure EU jurisdiction

The influx of talent drives ongoing rental demand, especially in Limassol.

2. Limited Supply of Modern, High-Quality Apartments

Demand continues to far exceed supply, especially in:

- Central Limassol

- Agios Athanasios

- Agios Nicolaos

- Neapolis

- The Historical Centre

Many buyers and tenants compete for limited new-build stock, resulting in faster sales and higher yields for investors.

3. Off-Plan Investments Delivering High Capital Growth

Off-plan properties remain the favoured choice for investors, offering:

- Lower entry pricing

- Flexible staged payments

- Early equity growth

- Higher rental absorption

- Modern, energy-efficient specifications

Square One’s off-plan developments have recorded capital appreciation between 8–12 per cent upon completion.

4. Strong Rental Market and Attractive Yields

According to market data and Square One’s investor performance:

- Long-term yields: 5–7%

- Short-term yields in central districts: higher, depending on occupancy

- Relocation-driven demand ensures low vacancy rates

Square One’s partner, Moving Doors, enhances stability with rental guarantees up to 7% on selected units.

Limassol: The Strongest and Most Resilient Market in Cyprus

Although November showed a slight year-on-year decrease in transaction numbers, Limassol remains:

- The most transacted district

- The most desirable for international relocations

- The highest yielding rental market

- The most supply-constrained area in Cyprus

Its combination of business infrastructure, lifestyle amenities, and limited central land availability makes it uniquely positioned for long-term appreciation.

Square One’s developments in Agios Athanasios, Neapolis, Agios Nicolaos, Agia Zoni and the Historical Centre directly respond to this demand by offering modern, optimised apartments with strong rental performance.

For more market insights, refer to:

- Cyprus Real Estate Market Overview 2024

- Overview of the Cyprus Rental Market in 2024

- Buy-to-Let Guide Limassol: Benefits of Investing with SQONE

Outlook for 2026: Continued Growth and Strong Investment Conditions

With demand consistently rising and supply remaining limited, Cyprus is well-positioned to continue its growth into 2026.

Key trends expected to define the upcoming year include:

- Increased investment in central urban regeneration

- Growing appeal of energy-efficient residential projects

- Expanding relocation demand, especially in Limassol

- Continued strong performance of off-plan projects

- Increasing focus on rental guarantees and turnkey solutions

- Higher integration of smart amenities, co-working spaces, and communal facilities

Investors entering the market now are well-positioned to benefit from long-term capital appreciation and rental income growth.

Conclusion

Cyprus is on track for its best performing real estate year since 2007—and market fundamentals suggest that this upward trajectory will continue.

With consistent transaction growth, strong rental demand, and a supply-constrained market, the island remains one of Europe’s most attractive investment destinations.

Square One stands at the forefront of this momentum, delivering modern, high-yield residential projects in the most strategically positioned districts.

For investors seeking performance, long-term stability, and premium design, now is a compelling time to secure a property in Limassol.

- Email: invest@squareone.com.cy

- Website: https://www.squareone.com.cy/

Contact an expert today and secure your next high-performing investment with Square One.